Economy pills for the table-talk

💊 The first and most important, stop to think that everything that surrounds us was not always here. Hospitals, roads, schools… are the legacy of those who came before us.

💊 The second, simpler, if possible, if you spend money more than you earn, you become poorer. From here, everything else is flourishes.

💊 The objective of capitalism is to accumulate capital, accumulate savings, and in any case invest them, but not spend. Consumerism is a social democratic thing.

💊 The accumulation of this capital should come from different sources, known as assets. Never bet on a single asset, especially if it is not stable. And if it is not, as unfortunately happens with the regimes supported by their fossil fuels, then expand the range of these geopolitical ‘friends’. Germany is the best example of how not to do things in the case of energy policy.

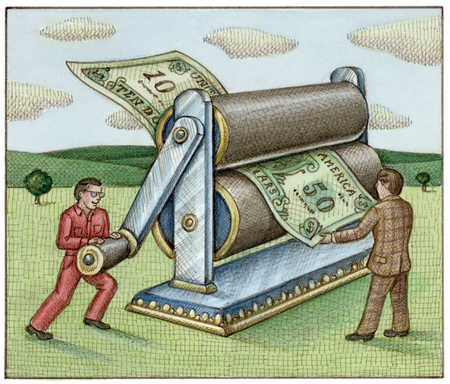

💊 The tremendous current inflation, ‘prices are soaring’, is the cold of a giant called the United States that, after the stoppage of the pandemic, printed money as if there were no tomorrow to reactivate the economy. Those warm pieces of money were put into circulation through aid and subsidies, and from banks to lend to eager customers. Consequently, demand increased. Here is another lesson: when you print money with no relation to capital, without anything real, it makes everything more expensive. Think of a boatman who is presented with several people to cross them to the other side of the river, but he can only take one. At first, he opts for the one that offers him €5 instead of another who wants to go for free, but then another one arrives with €20 and finally one with €100. The boatman, who would cost the same effort to cross the river, chooses for its benefit to the one who offers the €100. It is an absurd example but I hope it is illustrative. What has happened here is that the inflation that ‘has put those €100’ in the pocket of a client has devalued the purchasing power of others. In other words, cheapening money makes inflation rise.

|

💊 In Europe, on the other hand, inflation is not due to excessive demand by believing that we have more money like the guy with €100, but rather due to a crisis based on supply. In Europe, what is offered cannot be cheaper because we are a small continent that is extremely dependent on foreign resources, and after the pandemic and the Russia-Ukraine war, those resources are more limited than ever. It also doesn’t help that these resources are concentrated in so few countries, one of them being China. I go back to pill 4th: for some reason, it occurred to ‘someone’ that China was the factory of the world. There were reasons, but the most important one is the absence of social rights for the worker (despite being a communist country, what a surprise…), and in China there are maaaaany workers who also do it well. Now China needs those resources to recover itself after the pandemic and continue on the podium of world economies. Yes, pill 4th is very important.

💊 Whether by demand or supply, inflation is every government’s wet dream. Thanks to it, they collect more, and this year has been somewhat exaggerated (in Spain, an all-time high in October 2022 with more than 100,000 million euros for the Treasury). In addition to the fact that more money is synonymous with more power, and all of us, especially politicians, aspire to it, inflation helps to pay off the debt. If you earn €20,000 a year and take a mortgage with a house of €200,000, that’s 10 years of your salary. But if there is inflation and in theory your salary increases to match €40,000, your debt is reduced to 5 years of your salary. It is again an absurd example, but this is more or less how the State does when it charges more due to inflation to pay the debt. Spain, by the way, reached 120% of its GDP in debt, so inflation is more necessary than ever for the government.

Have I already told you that inflation is convenient for the States? Paradoxically, it is the citizens who demand measures to stop it. I can’t find a better analogy than asking a fox to take care of your chickens.

💊 Having said this, knowing that as much as Europe did well to cushion the negative consequences of inflation, the only thing that counts for the European central bank is how Germany does it. As much as inflation falls in the rest of the countries, the absolute priority is that it does not rise any further in Germany. And this is so because it is the economic locomotive of Europe, the one that exports the most and the one that injects the most money into European funds, thus pulling the others. Besides, Germany pays its debts, and whenever it has had a crisis, it has risen up more powerful than before. In other words, in addition to being an economic giant, it is a reliable partner. Shall we go a little deeper? Roughly speaking, the less cheap it is to replace people, the better for the economy. This is what is called the economic complexity of a society. It measures the time it takes to replace the workforce in an environment. If people need high formation and have high value, it is more difficult to replace them. Waiters, it’s easy to replace. Engineers, less. The lower that rate is, the longer and deeper are those economic crises. Germany has that rate very high, and the lowest… guess who? Exactly, of course, Spain. That low index offers more immediate benefits (beach bars, hotels, football, etc.), just enough to survive the next elections!

💊 Finally, acceding to the European Union did not balance all of us equally. Before, when we were doing badly, every time the economy lost strength, and we could devalue the peseta (Spanish coin before the euro) and, in a world not as globalized as the current one, the damage was not so serious. In 2008, when the oversized housing sector burst, we had to somehow devalue our economy... but without ‘touching’ the euro. Therefore, we devalue by salary. Before 2008, being a mileurista (earning €1,000 of salary per month) was pejorative. Since then, a dream that half of the Spanish population aspires to.

Comentarios

Publicar un comentario